Multiple Linear Regression

Types of Predictors

Prof. Maria Tackett

Topics

Mean-centering quantitative predictors

Using indicator variables for categorical predictors

Using interaction terms

Peer-to-peer lender

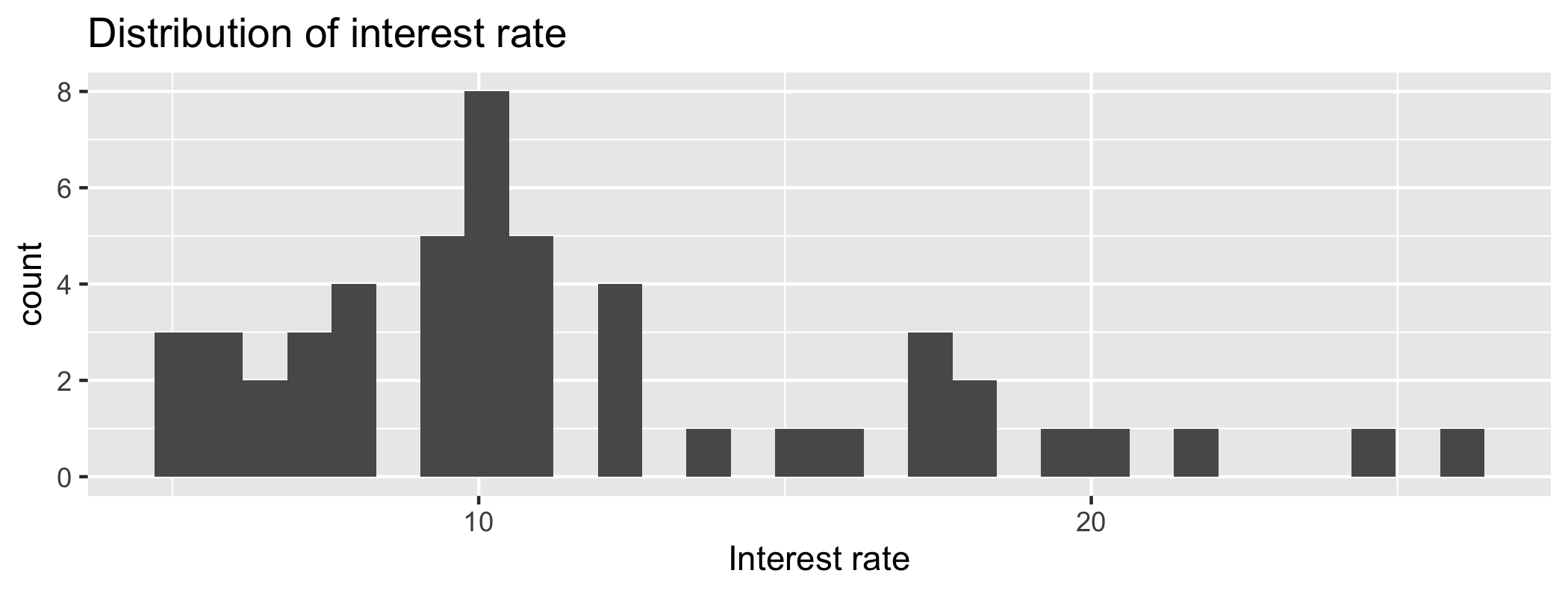

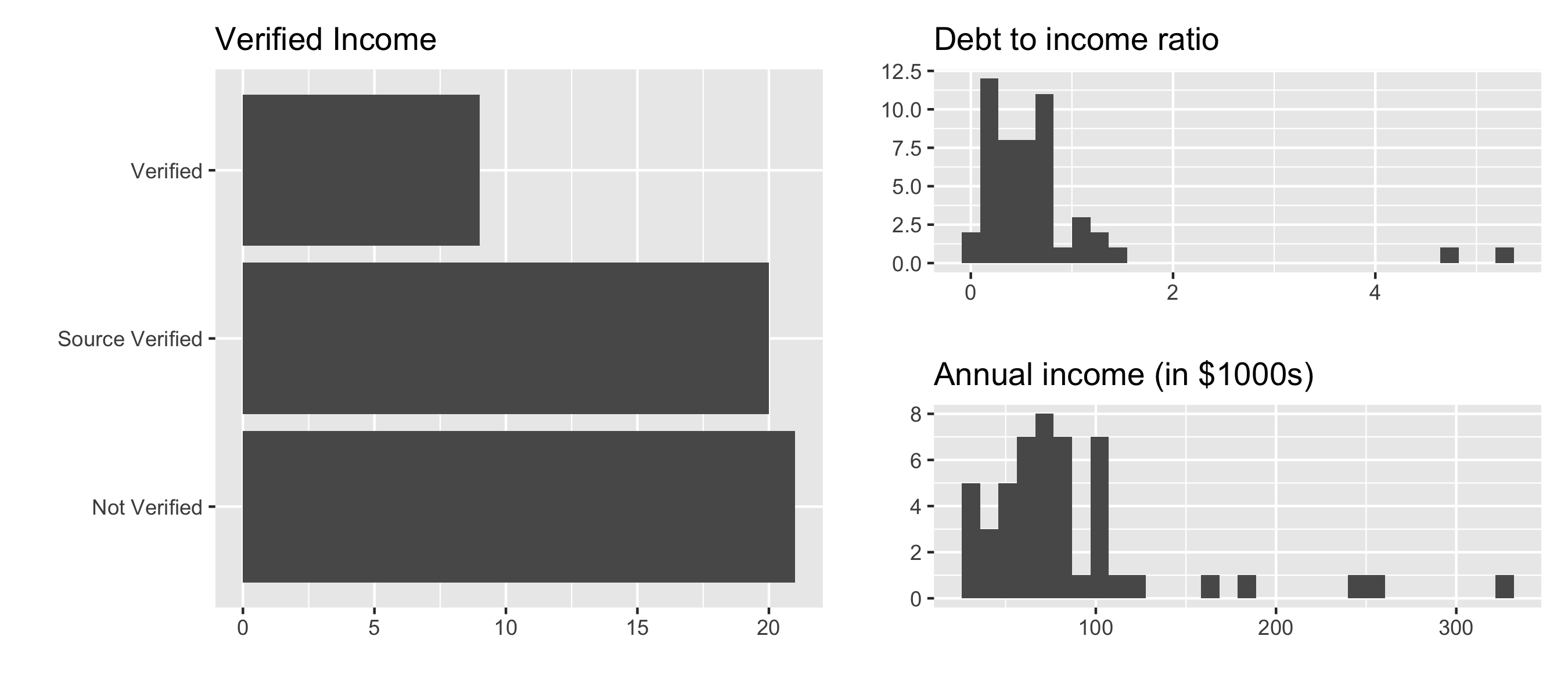

Today's data is a sample of 50 loans made through a peer-to-peer lending club. The data is in the loan50 data frame in the openintro R package.

Variables

Predictors

verified_income: Whether borrower's income source and amount have been verified (Not Verified,Source Verified,Verified)debt_to_income: Debt-to-income ratio, i.e. the percentage of a borrower's total debt divided by their total incomeannual_income: Annual income (in $1000s)

Response

interest_rate: Interest rate for the loan

Predictor variables

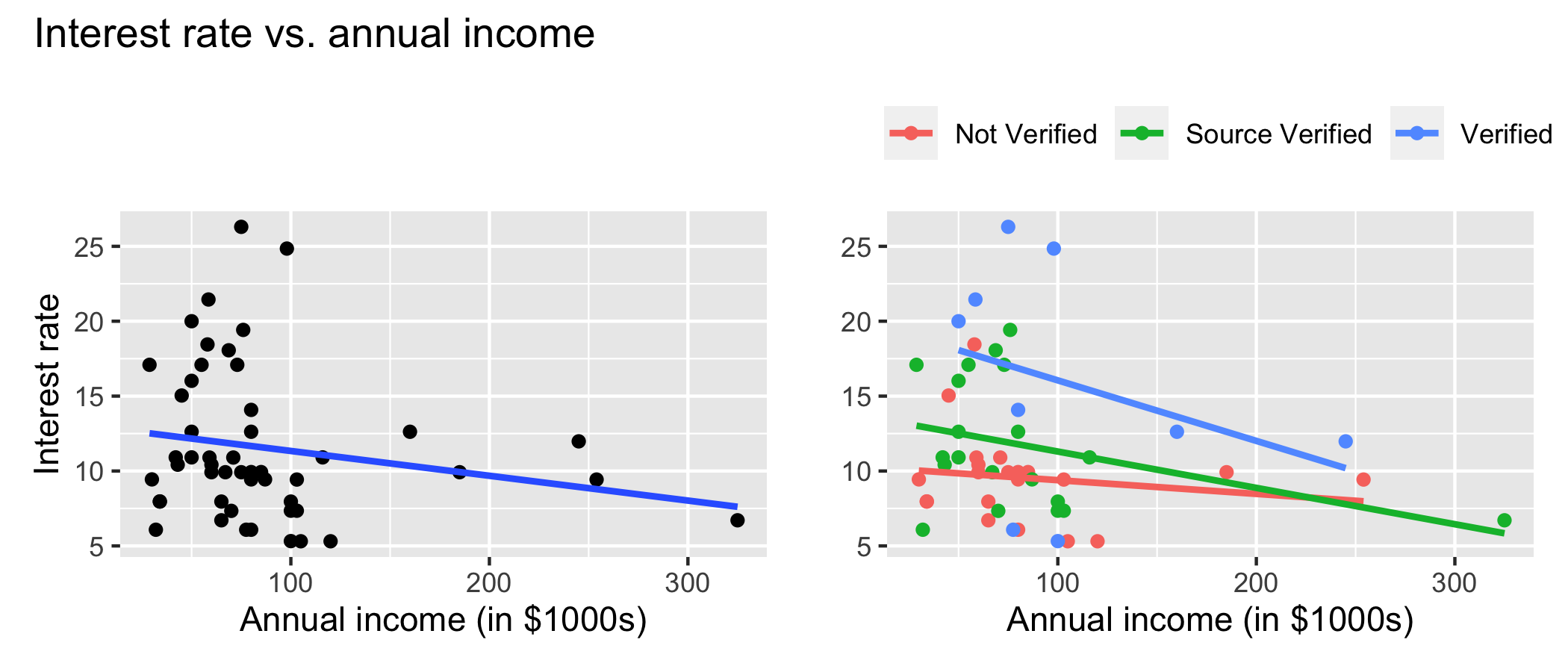

Response vs. Predictors

Regression Model

| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 10.726 | 1.507 | 7.116 | 0.000 | 7.690 | 13.762 |

| debt_to_income | 0.671 | 0.676 | 0.993 | 0.326 | -0.690 | 2.033 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 | -0.606 | 5.028 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 | 3.253 | 10.508 |

| annual_income | -0.021 | 0.011 | -1.804 | 0.078 | -0.043 | 0.002 |

Regression Model

| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 10.726 | 1.507 | 7.116 | 0.000 | 7.690 | 13.762 |

| debt_to_income | 0.671 | 0.676 | 0.993 | 0.326 | -0.690 | 2.033 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 | -0.606 | 5.028 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 | 3.253 | 10.508 |

| annual_income | -0.021 | 0.011 | -1.804 | 0.078 | -0.043 | 0.002 |

- Describe the subset of borrowers who are expected to get an interest rate of 10.726% based on our model

- Is this interpretation meaningful? Why or why not?

Mean-centered variables

Mean-Centered Variables

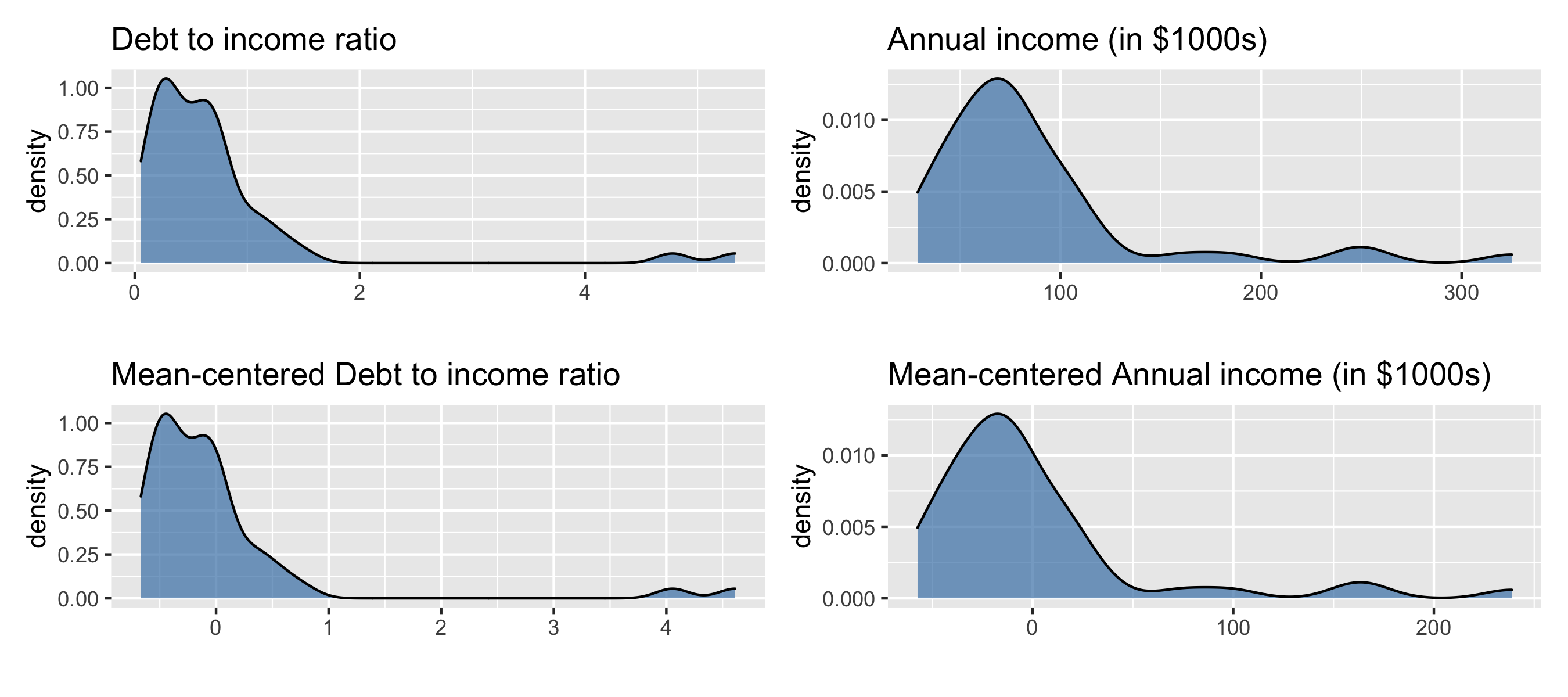

If we are interested in interpreting the intercept, we can mean-center the quantitative predictors in the model.

We can mean-center a quantitative predictor Xj using the following:

XjCent=Xj−ˉXj

Mean-Centered Variables

If we are interested in interpreting the intercept, we can mean-center the quantitative predictors in the model.

We can mean-center a quantitative predictor Xj using the following:

XjCent=Xj−ˉXj

If we mean-center all quantitative variables, then the intercept is interpreted as the expected value of the response variable when all quantitative variables are at their mean value.

Loans data: mean-center variables

Using mean-centere variables in the model

How do you expect the model to change if we use the debt_inc_cent and annual_income_cent in the model?

Using mean-centere variables in the model

How do you expect the model to change if we use the debt_inc_cent and annual_income_cent in the model?

| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 9.444 | 0.977 | 9.663 | 0.000 | 7.476 | 11.413 |

| debt_inc_cent | 0.671 | 0.676 | 0.993 | 0.326 | -0.690 | 2.033 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 | -0.606 | 5.028 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 | 3.253 | 10.508 |

| annual_income_cent | -0.021 | 0.011 | -1.804 | 0.078 | -0.043 | 0.002 |

Original vs. mean-centered model

| term | estimate |

|---|---|

| (Intercept) | 10.726 |

| debt_to_income | 0.671 |

| verified_incomeSource Verified | 2.211 |

| verified_incomeVerified | 6.880 |

| annual_income | -0.021 |

| term | estimate |

|---|---|

| (Intercept) | 9.444 |

| debt_inc_cent | 0.671 |

| verified_incomeSource Verified | 2.211 |

| verified_incomeVerified | 6.880 |

| annual_income_cent | -0.021 |

Indicator variables

Indicator variables

Suppose there is a categorical variable with K categories (levels)

We can make K indicator variables - one indicator for each category

An indicator variable takes values 1 or 0

- 1 if the observation belongs to that category

- 0 if the observation does not belong to that category

Indicator variable for verified_income

loan50 <- loan50 %>% mutate(not_verified = if_else(verified_income == "Not Verified", 1, 0), source_verified = if_else(verified_income == "Source Verified", 1, 0), verified = if_else(verified_income == "Verified", 1, 0) )Indicator variable for verified_income

loan50 <- loan50 %>% mutate(not_verified = if_else(verified_income == "Not Verified", 1, 0), source_verified = if_else(verified_income == "Source Verified", 1, 0), verified = if_else(verified_income == "Verified", 1, 0) )## # A tibble: 3 x 4## verified_income not_verified source_verified verified## <fct> <dbl> <dbl> <dbl>## 1 Not Verified 1 0 0## 2 Verified 0 0 1## 3 Source Verified 0 1 0Indicators in the model

We will use K−1 of the indicator variables in the model

The baseline is the category that doesn't have a term in the model.

The coefficients of the indicator variables in the model are interpreted as the expected change in the response compared to the baseline, holding all other variables constant.

Interpreting verified_income

| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 9.444 | 0.977 | 9.663 | 0.000 | 7.476 | 11.413 |

| debt_inc_cent | 0.671 | 0.676 | 0.993 | 0.326 | -0.690 | 2.033 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 | -0.606 | 5.028 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 | 3.253 | 10.508 |

| annual_income_cent | -0.021 | 0.011 | -1.804 | 0.078 | -0.043 | 0.002 |

Interpreting verified_income

| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 9.444 | 0.977 | 9.663 | 0.000 | 7.476 | 11.413 |

| debt_inc_cent | 0.671 | 0.676 | 0.993 | 0.326 | -0.690 | 2.033 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 | -0.606 | 5.028 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 | 3.253 | 10.508 |

| annual_income_cent | -0.021 | 0.011 | -1.804 | 0.078 | -0.043 | 0.002 |

The baseline category is "Not verified".

Interpreting verified_income

A person with source verified income is expected to take a loan with an interest rate that is 2.211% higher than the rate on loans to those whose income is not verified, holding all else constant.

Interpreting verified_income

A person with source verified income is expected to take a loan with an interest rate that is 2.211% higher than the rate on loans to those whose income is not verified, holding all else constant.

A person with verified income is expected to take a loan with an interest rate that is 6.880% higher than the rate on loans to those whose income is not verified, holding all else constant.

Interaction terms

Interaction Terms

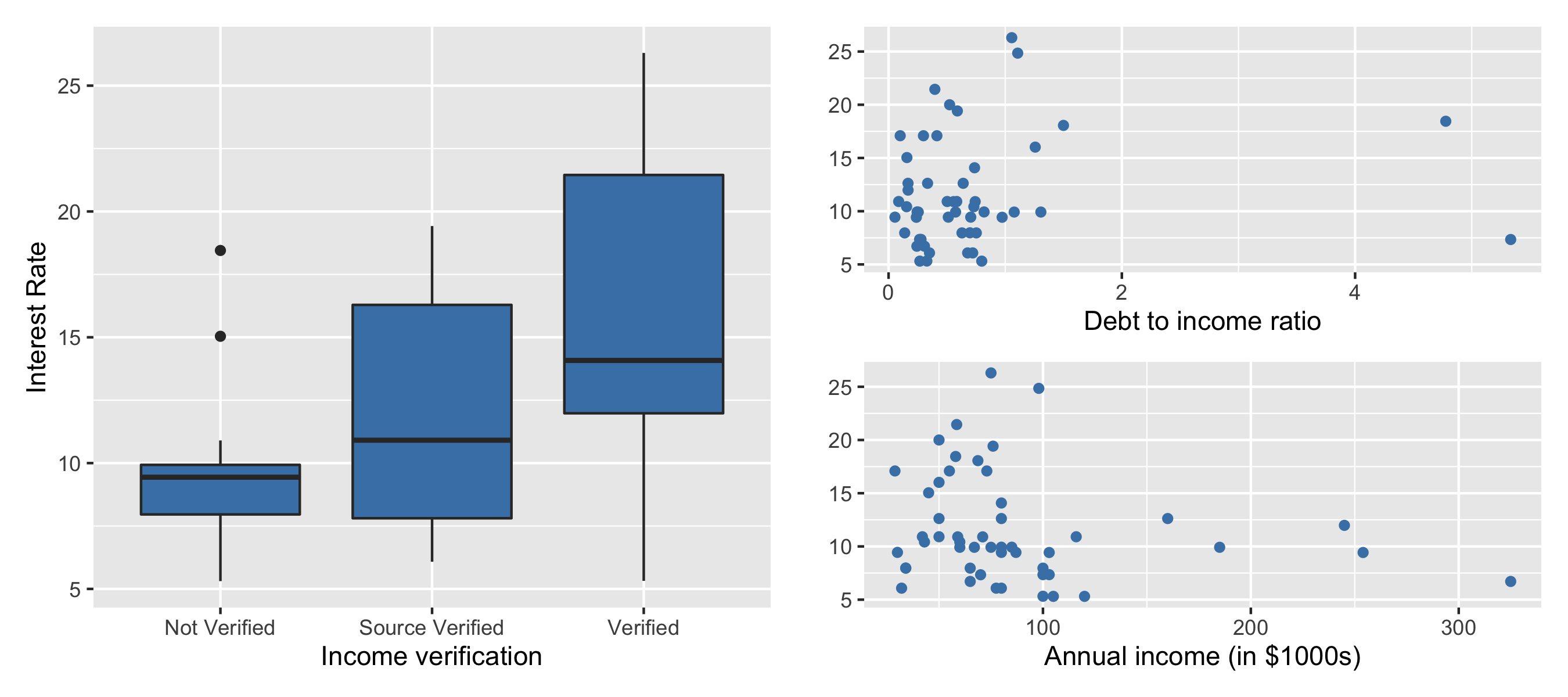

Sometimes the relationship between a predictor variable and the response depends on the value of another predictor variable

This is an interaction effect

To account for this, we can include interaction terms in the model.

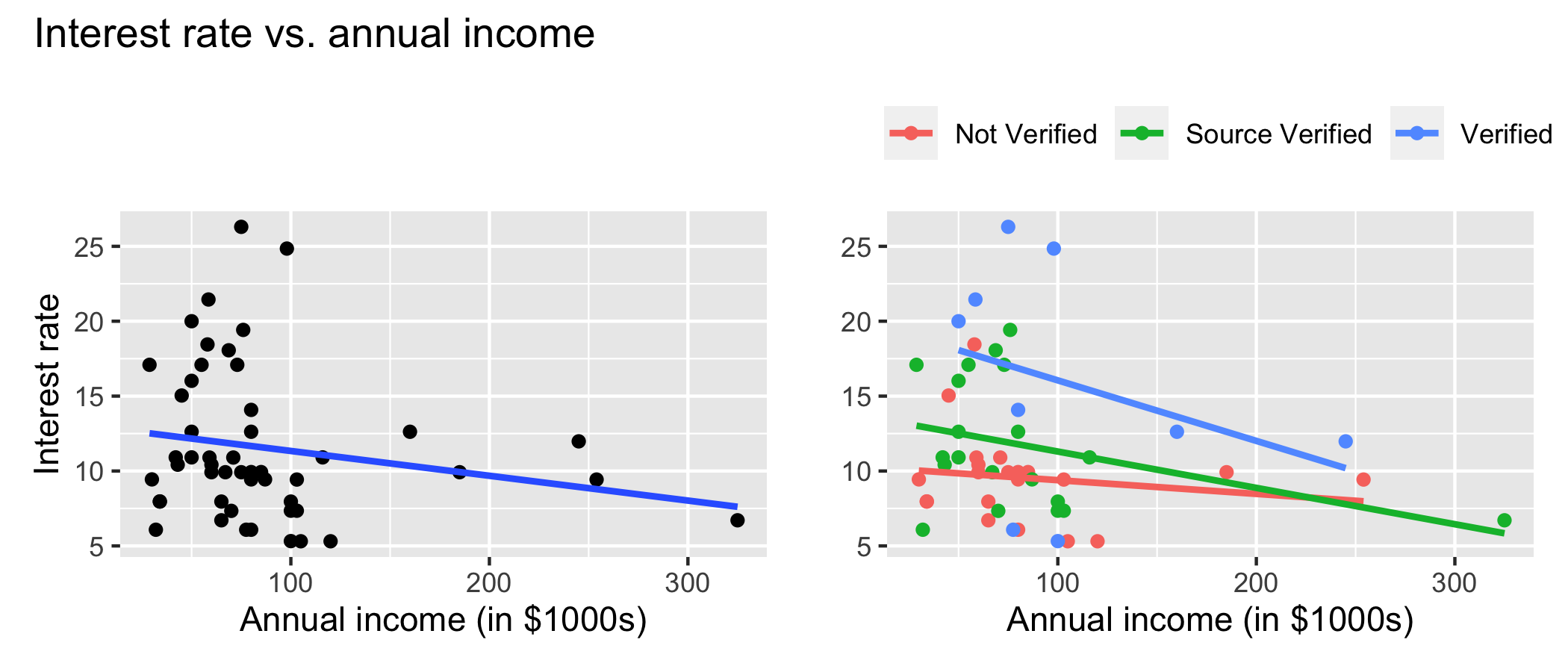

Interest rate vs. annual income

Interest rate vs. annual income

The lines are not parallel indicating there is an interaction effect. The slope of annual income differs based on the income verification.

Interaction term in model

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 9.484 | 0.989 | 9.586 | 0.000 |

| debt_inc_cent | 0.691 | 0.685 | 1.009 | 0.319 |

| annual_income_cent | -0.007 | 0.020 | -0.341 | 0.735 |

| verified_incomeSource Verified | 2.157 | 1.418 | 1.522 | 0.135 |

| verified_incomeVerified | 7.181 | 1.870 | 3.840 | 0.000 |

| annual_income_cent:verified_incomeSource Verified | -0.016 | 0.026 | -0.643 | 0.523 |

| annual_income_cent:verified_incomeVerified | -0.032 | 0.033 | -0.979 | 0.333 |

Interpreting interaction terms

What the interaction means:

The effect of annual income on the interest rate differs by -0.016 when the income is source verified compared to when it is not verified, holding all else constant.

Interpreting interaction terms

What the interaction means:

The effect of annual income on the interest rate differs by -0.016 when the income is source verified compared to when it is not verified, holding all else constant.

Interpreting annual_income for source verified:

If the income is source verified, we expect the interest rate to decrease by 0.023% (-0.007 + -0.016) for each additional thousand dollars in annual income, holding all else constant.

Recap

Mean-centering quantitative predictors

Using indicator variables for categorical predictors

Using interaction terms