Multiple linear regression

Prof. Maria Tackett

Topics

Introduce multiple linear regression

Interpret a coefficient ˆβj

Use the model to calculate predicted values and the corresponding interval

House prices in Levittown

The data set contains the sales price and characteristics of 85 homes in Levittown, NY that sold between June 2010 and May 2011.

Levittown was built right after WWII and was the first planned suburban community built using mass production techniques.

The article "Levittown, the prototypical American suburb – a history of cities in 50 buildings, day 25" gives an overview of Levittown's controversial history.

Analysis goals

We would like to use the characteristics of a house to understand variability in the sales price.

To do so, we will fit a multiple linear regression model

Using our model, we can answers questions such as

- What is the relationship between the characteristics of a house in Levittown and its sale price?

- Given its characteristics, what is the expected sale price of a house in Levittown?

The data

## # A tibble: 10 x 7## bedrooms bathrooms living_area lot_size year_built property_tax sale_price## <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>## 1 4 1 1380 6000 1948 8360 350000## 2 4 2 1761 7400 1951 5754 360000## 3 4 2 1564 6000 1948 8982 350000## 4 5 2 2904 9898 1949 11664 375000## 5 5 2.5 1942 7788 1948 8120 370000## 6 4 2 1830 6000 1948 8197 335000## 7 4 1 1585 6000 1948 6223 295000## 8 4 1 941 6800 1951 2448 250000## 9 4 1.5 1481 6000 1948 9087 299990## 10 3 2 1630 5998 1948 9430 375000Variables

Predictors

bedrooms: Number of bedroomsbathrooms: Number of bathroomsliving_area: Total living area of the house (in square feet)lot_size: Total area of the lot (in square feet)year_built: Year the house was builtproperty_tax: Annual property taxes (in U.S. dollars)

Response

sale_price: Sales price (in U.S. dollars)

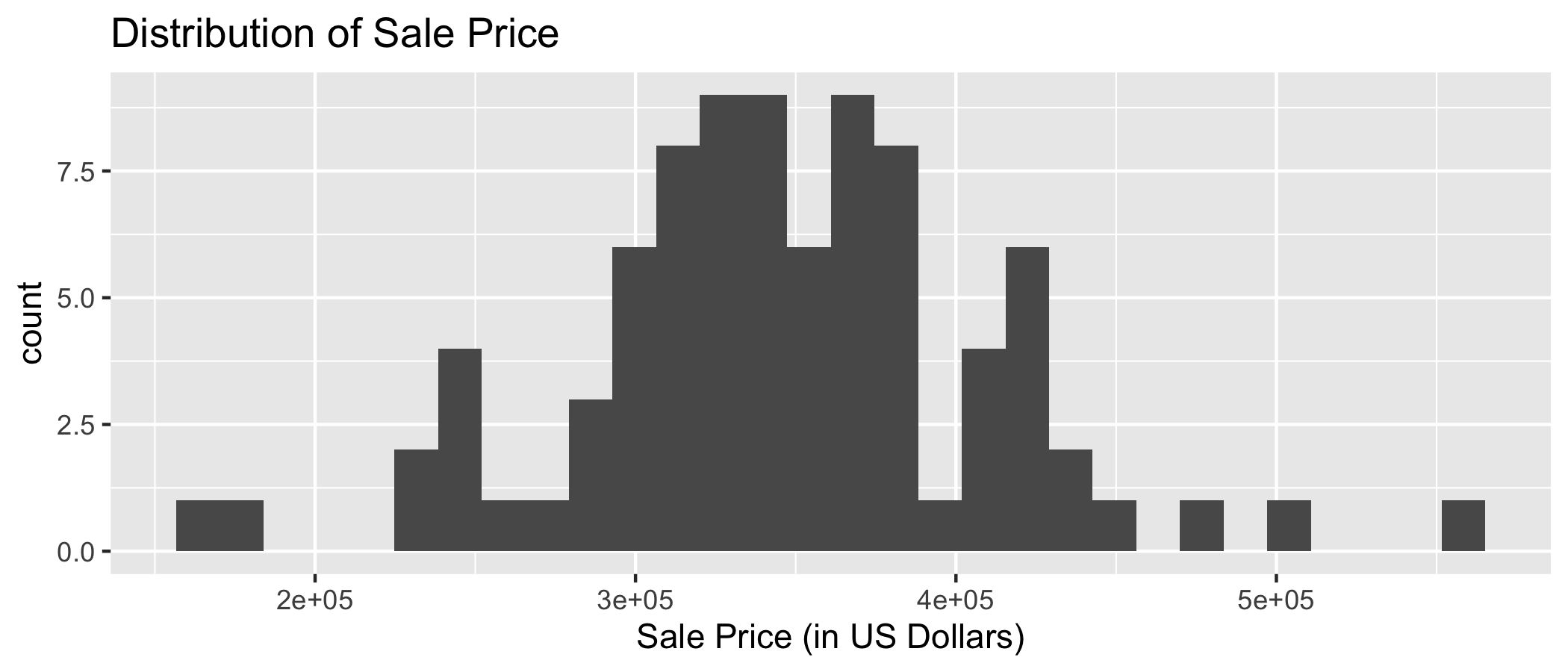

EDA: Response variable

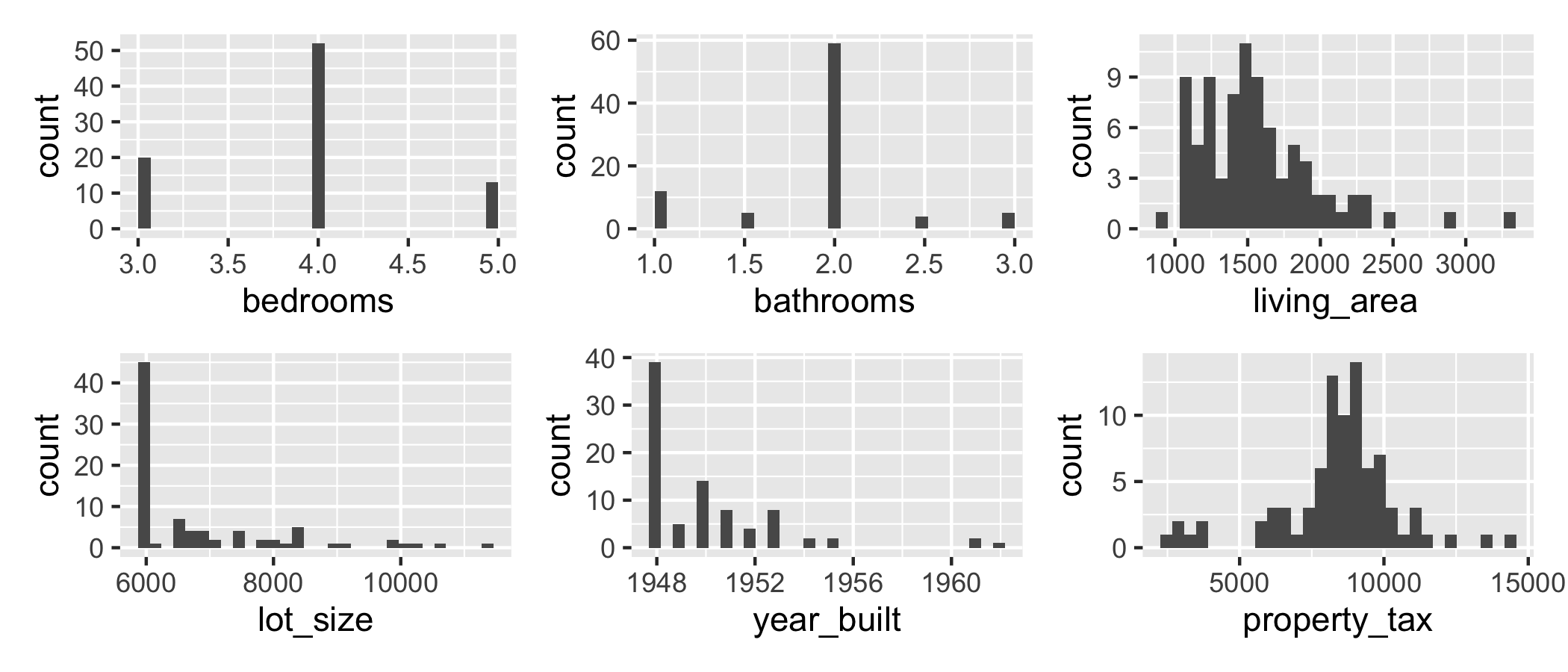

EDA: Predictor variables

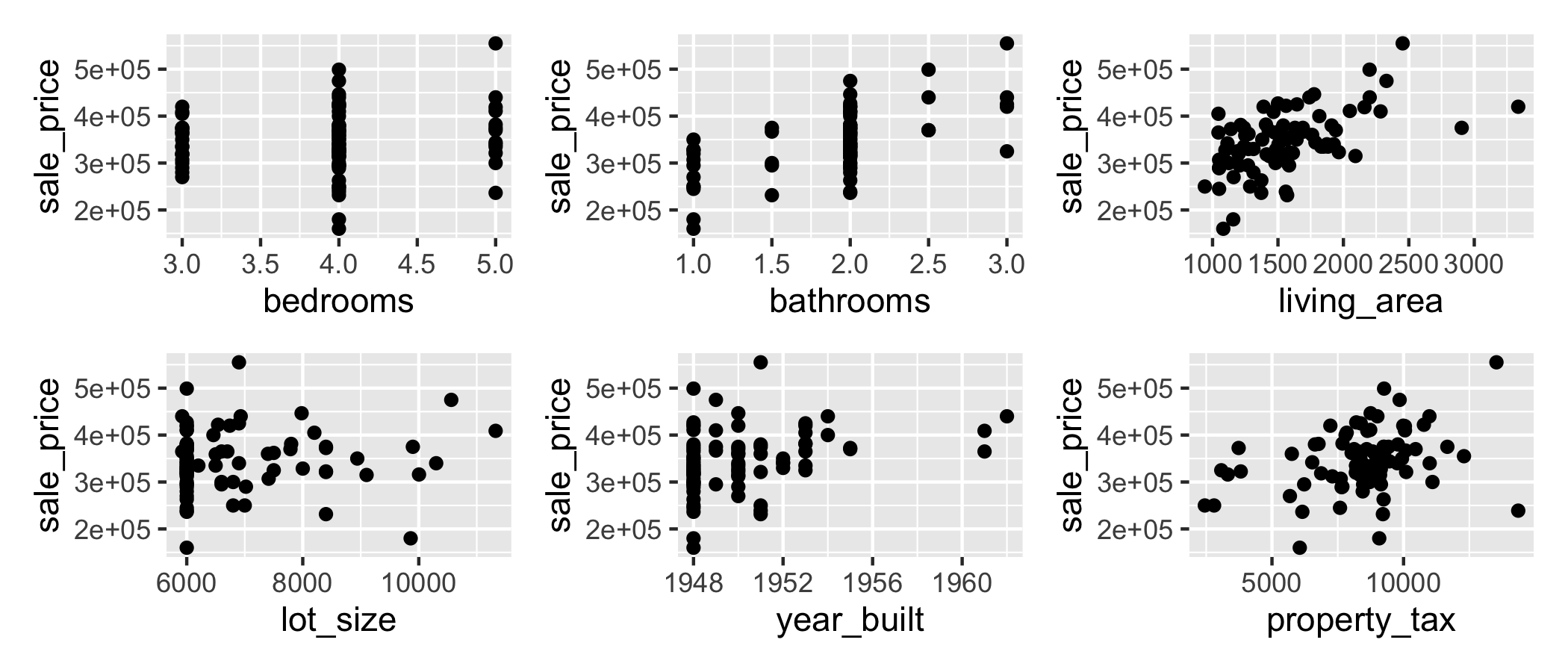

EDA: Response vs. Predictors

So far we've used a single predictor variable to understand variation in a quantitative response variable

So far we've used a single predictor variable to understand variation in a quantitative response variable

Now we want to use multiple predictor variables to understand variation in a quantitative response variable

Multiple linear regression (MLR)

Based on the analysis goals, we will use a multiple linear regression model of the following form

^sale_price = ˆβ0+ˆβ1bedrooms+ˆβ2bathrooms+ˆβ3living_area+ˆβ4lot_size+ˆβ5year_built+ˆβ6property_tax

Similar to simple linear regression, this model assumes that at each combination of the predictor variables, the values sale_price follow a Normal distribution

Regression Model

- Recall: The simple linear regression model assumes

Y|X∼N(β0+β1X,σ2ϵ)

Regression Model

- Recall: The simple linear regression model assumes

Y|X∼N(β0+β1X,σ2ϵ)

- Similarly: The multiple linear regression model assumes

Y|X1,X2,…,Xp∼N(β0+β1X1+β2X2+⋯+βpXp,σ2ϵ)

For a given observation (xi1,xi2…,xip,yi)

yi=β0+β1xi1+β2xi2+⋯+βpxip+ϵiϵi∼N(0,σ2ϵ)

Regression Model

- At any combination of the predictors, the mean value of the response Y, is

μY|X1,…,Xp=β0+β1X1+β2X2+⋯+βpXp

Regression Model

At any combination of the predictors, the mean value of the response Y, is μY|X1,…,Xp=β0+β1X1+β2X2+⋯+βpXp

Using multiple linear regression, we can estimate the mean response for any combination of predictors

ˆY=ˆβ0+ˆβ1X1+ˆβ2X2+⋯+ˆβpXp

Home price model

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | -7148818.957 | 3820093.694 | -1.871 | 0.065 |

| bedrooms | -12291.011 | 9346.727 | -1.315 | 0.192 |

| bathrooms | 51699.236 | 13094.170 | 3.948 | 0.000 |

| living_area | 65.903 | 15.979 | 4.124 | 0.000 |

| lot_size | -0.897 | 4.194 | -0.214 | 0.831 |

| year_built | 3760.898 | 1962.504 | 1.916 | 0.059 |

| property_tax | 1.476 | 2.832 | 0.521 | 0.604 |

^price=−7148818.957−12291.011×bedrooms+51699.236×bathrooms+65.903×living area−0.897×lot size+3760.898×year built+1.476×property tax

Interpreting ˆβj

- The estimated coefficient ˆβj is the expected change in the mean of y when xj increases by one unit, holding the values of all other predictor variables constant.

Interpreting ˆβj

- The estimated coefficient ˆβj is the expected change in the mean of y when xj increases by one unit, holding the values of all other predictor variables constant.

- Example: The estimated coefficient for

living_areais 65.90. This means for each additional square foot of living area, we expect the sale price of a house in Levittown, NY to increase by $65.90, on average, holding all other predictor variables constant.

Prediction

Example: What is the predicted sale price for a house in Levittown, NY with 3 bedrooms, 1 bathroom, 1050 square feet of living area, 6000 square foot lot size, built in 1948 with $6306 in property taxes?

-7148818.957 - 12291.011 * 3 + 51699.236 * 1 + 65.903 * 1050 - 0.897 * 6000 + 3760.898 * 1948 + 1.476 * 6306## [1] 265360.4Prediction

Example: What is the predicted sale price for a house in Levittown, NY with 3 bedrooms, 1 bathroom, 1050 square feet of living area, 6000 square foot lot size, built in 1948 with $6306 in property taxes?

-7148818.957 - 12291.011 * 3 + 51699.236 * 1 + 65.903 * 1050 - 0.897 * 6000 + 3760.898 * 1948 + 1.476 * 6306## [1] 265360.4The predicted sale price for a house in Levittown, NY with 3 bedrooms, 1 bathroom, 1050 square feet of living area, 6000 square foot lot size, built in 1948 with $6306 in property taxes is $265,360.

Intervals for predictions

Just like with simple linear regression, we can use the predict function in R to calculate the appropriate intervals for our predicted values

x0 <- data.frame(bedrooms = 3, bathrooms = 1, living_area = 1050, lot_size = 6000, year_built = 1948, property_tax = 6306)Confidence interval for ˆμy

Calculate a 95% confidence interval for the estimated mean price of houses in Levittown, NY with 3 bedrooms, 1 bathroom, 1050 square feet of living area, 6000 square foot lot size, built in 1948 with $6306 in property taxes:

predict(price_model, x0, interval = "confidence", level = 0.95)## fit lwr upr## 1 265360.2 238481.7 292238.7Prediction interval for ˆy

Calculate a 95% prediction interval for an individual house in Levittown, NY with 3 bedrooms, 1 bathroom, 1050 square feet of living area, 6000 square foot lot size, built in 1948 with $6306 in property taxes:

predict(price_model, x0, interval = "prediction", level = 0.95)## fit lwr upr## 1 265360.2 167276.8 363443.6🛑 Cautions

- Do not extrapolate! Because there are multiple predictor variables, there is the potential to extrapolate in many directions

🛑 Cautions

Do not extrapolate! Because there are multiple predictor variables, there is the potential to extrapolate in many directions

The multiple regression model only shows association, not causality

- To show causality, you must have a carefully designed experiment or carefully account for confounding variables in an observational study

Recap

Introduced multiple linear regression

Interpreted a coefficient ˆβj

Used the model to calculate predicted values and the corresponding interval