Model diagnostics

Prof. Maria Tackett

Topics

Identifying influential points

- Leverage

- Standardized residuals

- Cook's Distance

Multicollinearity

Influential points

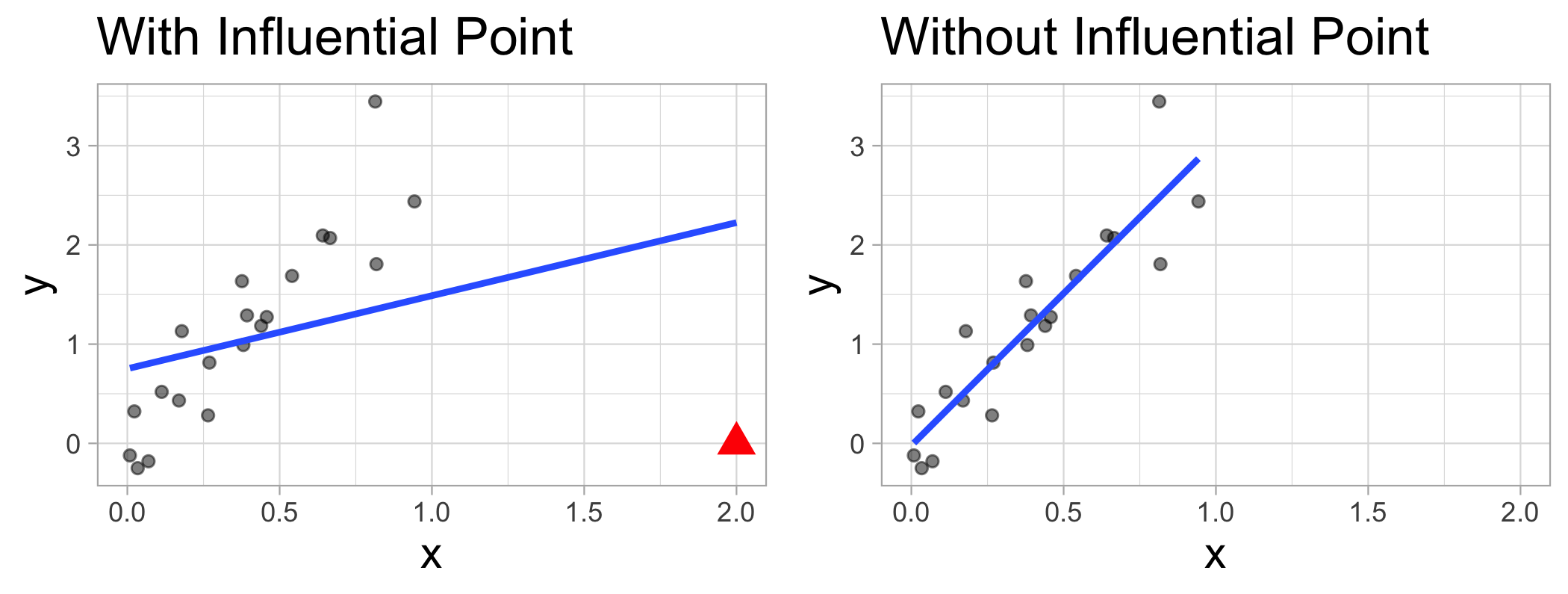

Influential Point

An observation is influential if removing it substantially changes the coefficients of the regression model

Influential points

- Influential points have a large impact on the coefficients and standard errors used for inference

Influential points

Influential points have a large impact on the coefficients and standard errors used for inference

These points can sometimes be identified in a scatterplot if there is only one predictor variable

- This is often not the case when there are multiple predictors

Influential points

Influential points have a large impact on the coefficients and standard errors used for inference

These points can sometimes be identified in a scatterplot if there is only one predictor variable

- This is often not the case when there are multiple predictors

We will use measures to quantify an individual observation's influence on the regression model

- leverage, standardized residuals, and Cook's distance

Model diagnostics in R

Use the augment function in the broom package to output the model diagnostics (along with the predicted values and residuals)

- response and predictor variables in the model

.fitted: predicted values.se.fit: standard errors of predicted values.resid: residuals.hat: leverage.sigma: estimate of residual standard deviation when the corresponding observation is dropped from model.cooksd: Cook's distance.std.resid: standardized residuals]

Example: SAT Averages by State

This data set contains the average SAT score (out of 1600) and other variables that may be associated with SAT performance for each of the 50 U.S. states. The data is based on test takers for the 1982 exam.

Response variable:

SAT: average total SAT score

Data comes from case1201 data set in the Sleuth3 package

SAT Averages: Predictors

Takers: percentage of high school seniors who took examIncome: median income of families of test-takers ($ hundreds)Years: average number of years test-takers had formal education in social sciences, natural sciences, and humanitiesPublic: percentage of test-takers who attended public high schoolsExpend: total state expenditure on high schools ($ hundreds per student)Rank: median percentile rank of test-takers within their high school classes

Model

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | -94.659 | 211.510 | -0.448 | 0.657 |

| Takers | -0.480 | 0.694 | -0.692 | 0.493 |

| Income | -0.008 | 0.152 | -0.054 | 0.957 |

| Years | 22.610 | 6.315 | 3.581 | 0.001 |

| Public | -0.464 | 0.579 | -0.802 | 0.427 |

| Expend | 2.212 | 0.846 | 2.615 | 0.012 |

| Rank | 8.476 | 2.108 | 4.021 | 0.000 |

SAT: Augmented Data

## Rows: 50## Columns: 14## $ SAT <int> 1088, 1075, 1068, 1045, 1045, 1033, 1028, 1022, 1017, 1011,…## $ Takers <int> 3, 2, 3, 5, 5, 8, 7, 4, 5, 10, 5, 4, 9, 8, 7, 3, 6, 16, 19,…## $ Income <int> 326, 264, 317, 338, 293, 263, 343, 333, 328, 304, 358, 295,…## $ Years <dbl> 16.79, 16.07, 16.57, 16.30, 17.25, 15.91, 17.41, 16.57, 16.…## $ Public <dbl> 87.8, 86.2, 88.3, 83.9, 83.6, 93.7, 78.3, 75.2, 97.0, 77.3,…## $ Expend <dbl> 25.60, 19.95, 20.62, 27.14, 21.05, 29.48, 24.84, 17.42, 25.…## $ Rank <dbl> 89.7, 90.6, 89.8, 86.3, 88.5, 86.4, 83.4, 85.9, 87.5, 84.2,…## $ .fitted <dbl> 1057.0438, 1037.6261, 1041.7431, 1021.3039, 1048.4680, 1013…## $ .resid <dbl> 30.9562319, 37.3739084, 26.2569334, 23.6961288, -3.4680381,…## $ .hat <dbl> 0.11609974, 0.16926150, 0.11000956, 0.06036139, 0.12261873,…## $ .sigma <dbl> 26.16716, 25.89402, 26.30760, 26.38760, 26.64972, 26.43025,…## $ .cooksd <dbl> 2.931280e-02, 7.051849e-02, 1.970989e-02, 7.901850e-03, 3.9…## $ .std.resid <dbl> 1.24986670, 1.55651598, 1.05649773, 0.92792786, -0.14054225…## $ obs_num <int> 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, …Leverage

Leverage

- Leverage: measure of the distance between an observation's values of the predictor variables and the average values of the predictor variables for the entire data set

Leverage

Leverage: measure of the distance between an observation's values of the predictor variables and the average values of the predictor variables for the entire data set

An observation has high leverage if its combination of values for the predictor variables is very far from the typical combination of values in the data

Leverage

Leverage: measure of the distance between an observation's values of the predictor variables and the average values of the predictor variables for the entire data set

An observation has high leverage if its combination of values for the predictor variables is very far from the typical combination of values in the data

Observations with high leverage should be considered as potential influential points

Calculating leverage

Simple Regression: leverage of the ith observation

hi=1n+(xi−ˉx)2∑nj=1(xj−ˉx)2

Calculating leverage

Simple Regression: leverage of the ith observation

hi=1n+(xi−ˉx)2∑nj=1(xj−ˉx)2

Multiple Regression: leverage of the ith observation is the ith diagonal of H=X(XTX)−1XT

Calculating leverage

Simple Regression: leverage of the ith observation

hi=1n+(xi−ˉx)2∑nj=1(xj−ˉx)2

Multiple Regression: leverage of the ith observation is the ith diagonal of H=X(XTX)−1XT

- Note: Leverage only depends on values of the predictor variables

High Leverage

The sum of the leverages for all points is p+1

- In the case of SLR ∑ni=1hi=2

High Leverage

The sum of the leverages for all points is p+1

In the case of SLR ∑ni=1hi=2

The "typical" leverage is (p+1)n

High Leverage

The sum of the leverages for all points is p+1

In the case of SLR ∑ni=1hi=2

The "typical" leverage is (p+1)n

An observation has high leverage if hi>2(p+1)n

High Leverage

If there is point with high leverage, ask

❓ Is there a data entry error?

❓ Is this observation within the scope of individuals for which you want to make predictions and draw conclusions?

❓ Is this observation impacting the estimates of the model coefficients, especially for interactions?

High Leverage

If there is point with high leverage, ask

❓ Is there a data entry error?

❓ Is this observation within the scope of individuals for which you want to make predictions and draw conclusions?

❓ Is this observation impacting the estimates of the model coefficients, especially for interactions?

Just because a point has high leverage does not necessarily mean it will have a substantial impact on the regression. Therefore we need to check other measures.

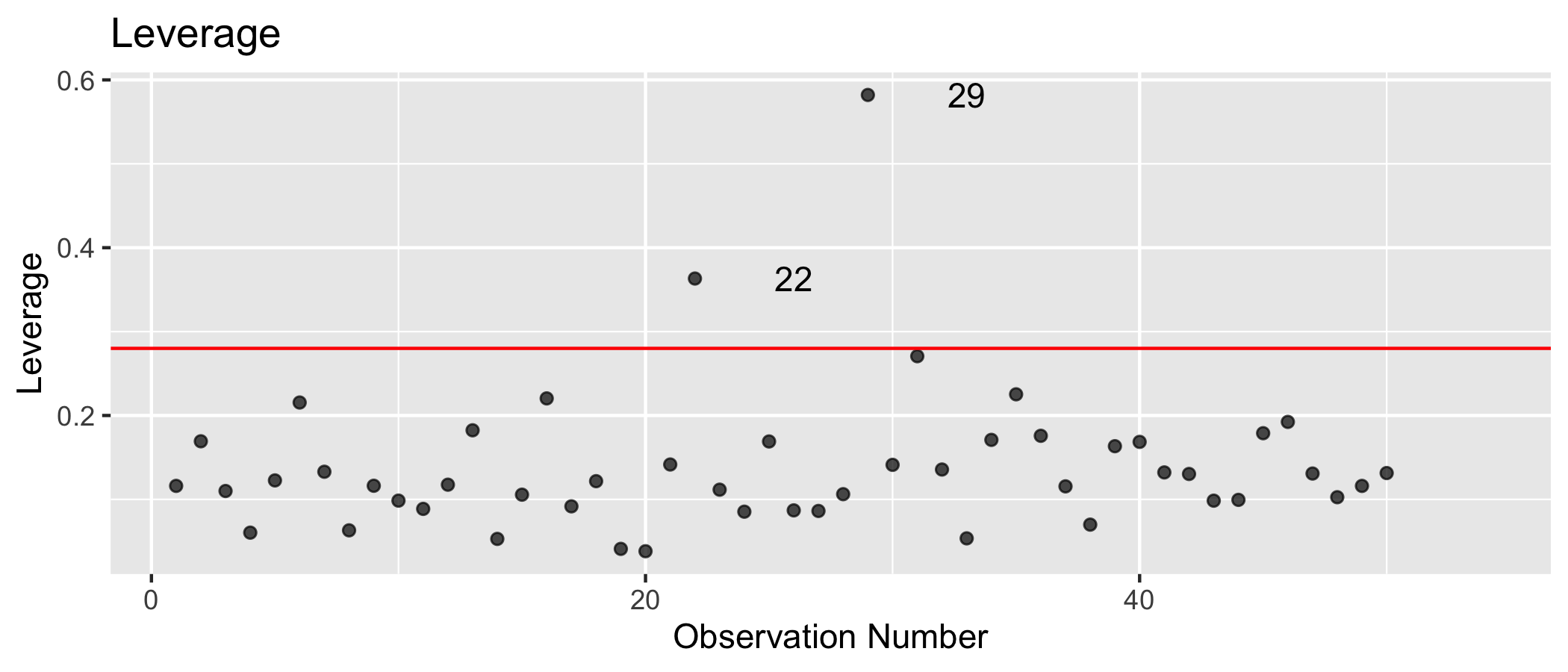

SAT: Leverage

High leverage if hi>2∗(6+1)50=0.28

Observations with high leverage

| obs_num | Takers | Income | Years | Public | Expend | Rank |

|---|---|---|---|---|---|---|

| 22 | 5 | 394 | 16.85 | 44.8 | 19.72 | 82.9 |

| 29 | 31 | 401 | 15.32 | 96.5 | 50.10 | 79.6 |

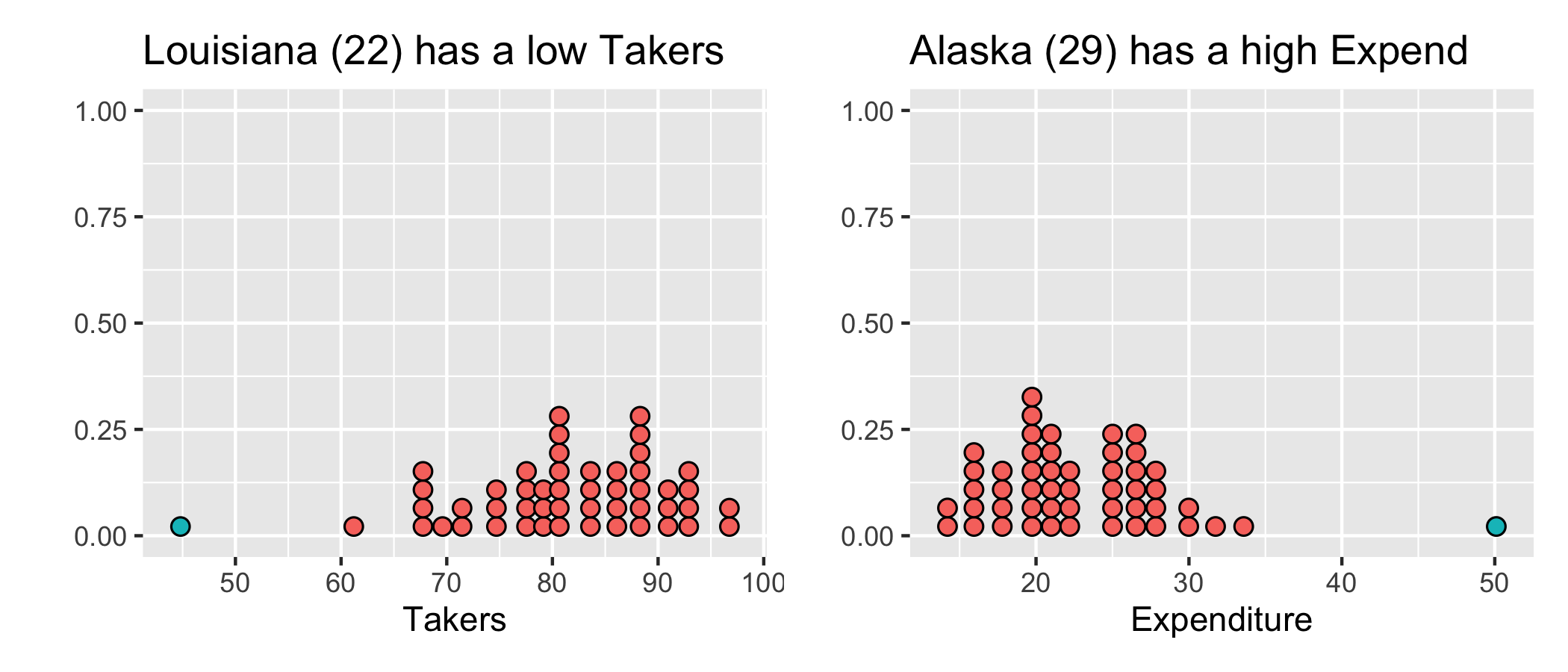

Why do you think these observations have high leverage?

Let's dig into the data

Standardized & Studentized Residuals

Standardized & Studentized Residuals

- What is the best way to identify outliers (points that don't fit the pattern from the regression line)?

Standardized & Studentized Residuals

What is the best way to identify outliers (points that don't fit the pattern from the regression line)?

Look for points that have large residuals

Standardized & Studentized Residuals

What is the best way to identify outliers (points that don't fit the pattern from the regression line)?

Look for points that have large residuals

We want a common scale, so we can more easily identify "large" residuals

Standardized & Studentized Residuals

What is the best way to identify outliers (points that don't fit the pattern from the regression line)?

Look for points that have large residuals

We want a common scale, so we can more easily identify "large" residuals

We will look at each residual divided by its standard error

Standardized & Studentized residuals

Standardized & Studentized residuals

std.resi=yi−ˆyiˆσϵ√1−hi

where ˆσϵ is the regression standard error

Standardized & Studentized residuals

std.resi=yi−ˆyiˆσϵ√1−hi

where ˆσϵ is the regression standard error

stud.resi=yi−ˆyiˆσ(i)√1−hi

Standardized & Studentized residuals

- Observations with high leverage tend to have low values of standardized residuals because they pull the regression line towards them

Standardized & Studentized residuals

Observations with high leverage tend to have low values of standardized residuals because they pull the regression line towards them

This issue is avoided using the studentized residuals, since the regression standard error is calculated without the possible influential point.

Standardized & Studentized residuals

Observations with high leverage tend to have low values of standardized residuals because they pull the regression line towards them

This issue is avoided using the studentized residuals, since the regression standard error is calculated without the possible influential point.

Standardized residuals are produced by

augmentin the column.std.resid

Standardized & Studentized residuals

Observations with high leverage tend to have low values of standardized residuals because they pull the regression line towards them

This issue is avoided using the studentized residuals, since the regression standard error is calculated without the possible influential point.

Standardized residuals are produced by

augmentin the column.std.residStudentized residuals can be calculated using

.sigma,.resid, and.hatproduced byaugment

Using standardized & studentized residuals

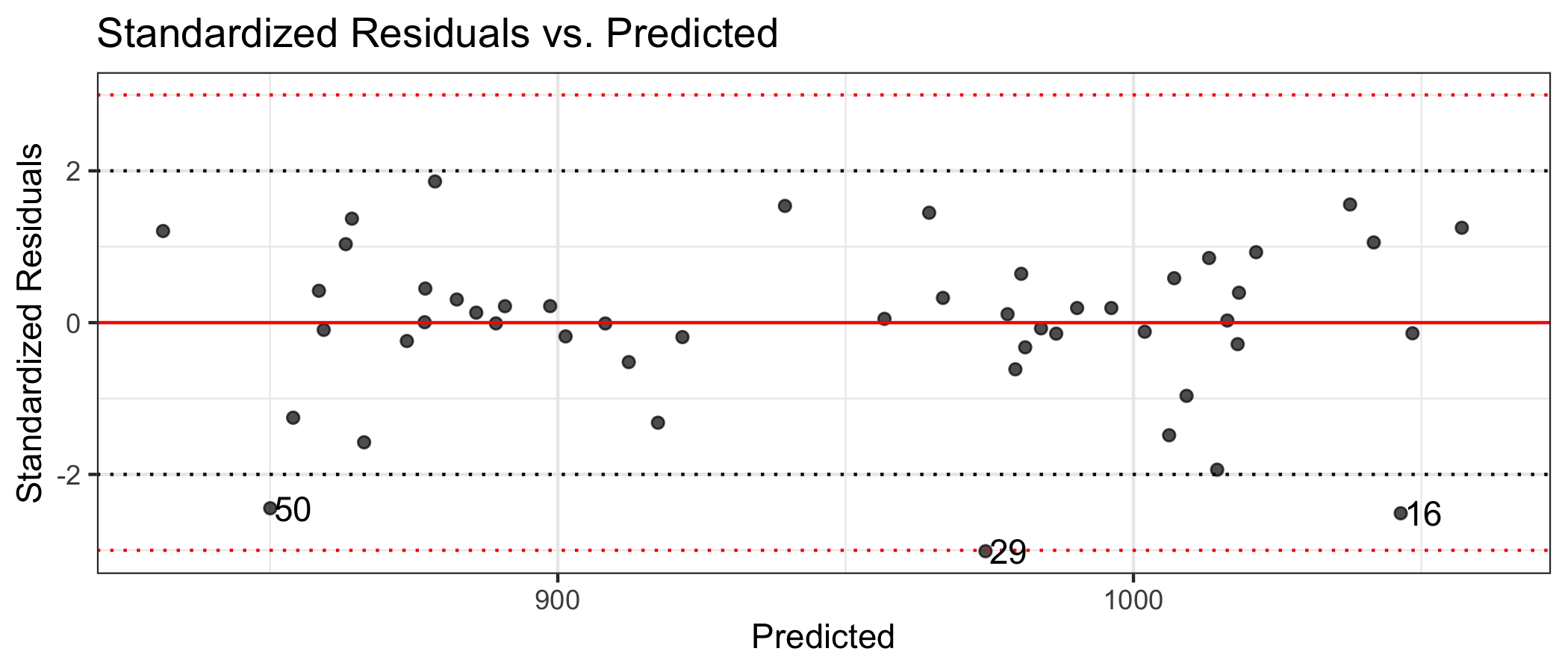

Observations that have standardized residuals of large magnitude are outliers, since they don't fit the pattern determined by the regression model

An observation is a moderate outlier if its standardized residual is beyond ±2.

An observation is a serious outlier if its standardized residual is beyond ±3.

Using standardized & studentized residuals

Observations that have standardized residuals of large magnitude are outliers, since they don't fit the pattern determined by the regression model

An observation is a moderate outlier if its standardized residual is beyond ±2.

An observation is a serious outlier if its standardized residual is beyond ±3.

Make residual plots with standardized residuals to make it easier to identify outliers and check constant variance condition.

SAT: Standardized residuals vs. predicted

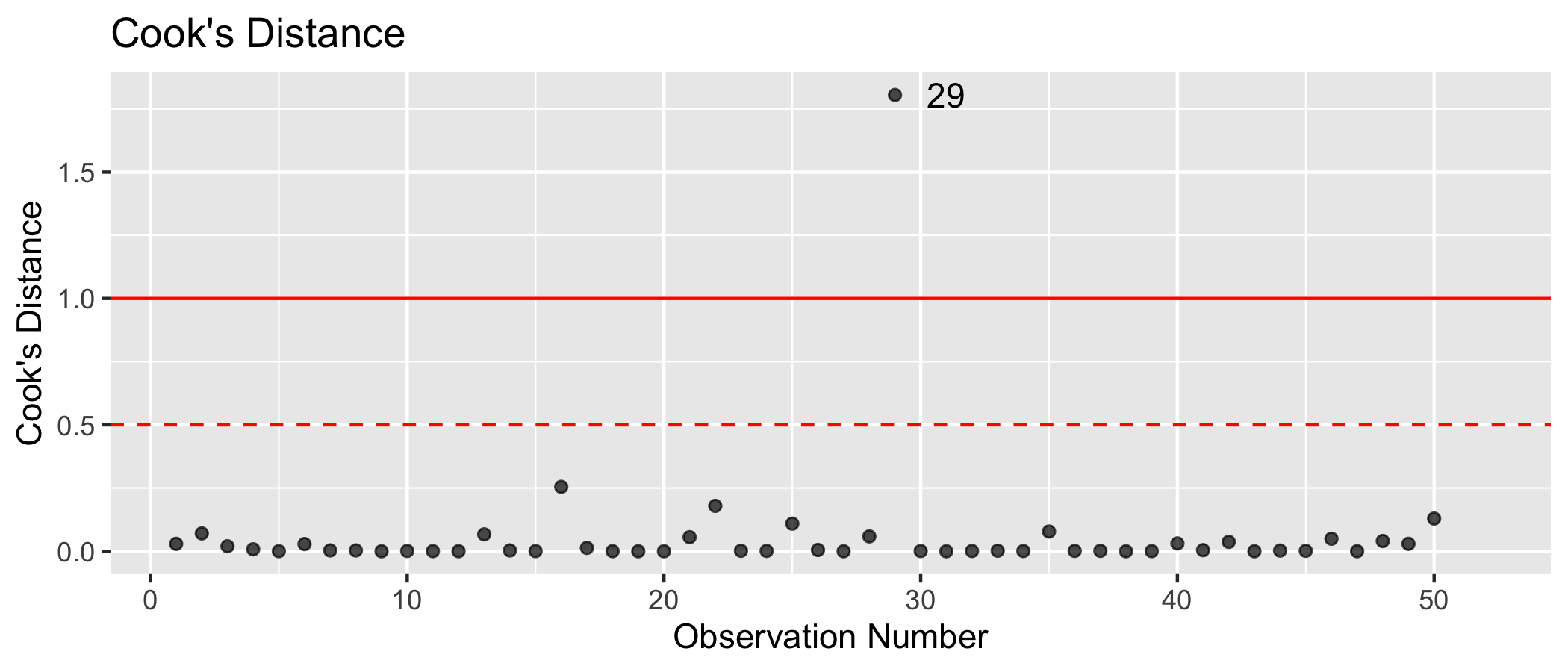

Cook's Distance

Motivating Cook's Distance

An observation's influence on the regression line depends on

How close it lies to the general trend of the data - std.residi

Its leverage - hi

Motivating Cook's Distance

An observation's influence on the regression line depends on

How close it lies to the general trend of the data - std.residi

Its leverage - hi

Cook's Distance is a statistic that includes both of these components to measure an observation's overall impact on the model

Cook's Distance

Cook's distance for the ith observation

Di=(std.resi)2p+1(hi1−hi)

Cook's Distance

Cook's distance for the ith observation

Di=(std.resi)2p+1(hi1−hi)

An observation with large Di is said to have a strong influence on the predicted values

Cook's Distance

Cook's distance for the ith observation

Di=(std.resi)2p+1(hi1−hi)

An observation with large Di is said to have a strong influence on the predicted values

An observation with

- Di>0.5 is moderately influential

- Di>1 is very influential

Cook's Distance

Influential point: Alaska

## # A tibble: 1 x 7## obs_num Takers Income Years Public Expend Rank## <int> <int> <int> <dbl> <dbl> <dbl> <dbl>## 1 29 31 401 15.3 96.5 50.1 79.6Influential point: Alaska

## # A tibble: 1 x 7## obs_num Takers Income Years Public Expend Rank## <int> <int> <int> <dbl> <dbl> <dbl> <dbl>## 1 29 31 401 15.3 96.5 50.1 79.6- high leverage 0.5820757

- large magnitude standardized residual -3.0119952

Model with and without Alaska

With Alaska

| term | estimate |

|---|---|

| (Intercept) | -94.659 |

| Takers | -0.480 |

| Income | -0.008 |

| Years | 22.610 |

| Public | -0.464 |

| Expend | 2.212 |

| Rank | 8.476 |

Model with and without Alaska

With Alaska

| term | estimate |

|---|---|

| (Intercept) | -94.659 |

| Takers | -0.480 |

| Income | -0.008 |

| Years | 22.610 |

| Public | -0.464 |

| Expend | 2.212 |

| Rank | 8.476 |

Without Alaska

| term | estimate |

|---|---|

| (Intercept) | -203.926 |

| Takers | 0.018 |

| Income | 0.181 |

| Years | 16.536 |

| Public | -0.443 |

| Expend | 3.730 |

| Rank | 9.789 |

Using these measures

Standardized residuals, leverage, and Cook's Distance should all be examined together

Examine plots of the measures to identify observations that are outliers, high leverage, and may potentially impact the model.

What to do with outliers/influential points?

It is OK to drop an observation based on the predictor variables if...

It is meaningful to drop the observation given the context of the problem

You intended to build a model on a smaller range of the predictor variables. Mention this in the write up of the results and be careful to avoid extrapolation when making predictions

What to do with outliers/influential points?

It is not OK to drop an observation based on the response variable

These are legitimate observations and should be in the model

You can try transformations or increasing the sample size by collecting more data

What to do with outliers/influential points?

It is not OK to drop an observation based on the response variable

These are legitimate observations and should be in the model

You can try transformations or increasing the sample size by collecting more data

In either instance, you can try building the model with and without the outliers/influential observations

See the supplemental notes Details on Model Diagnostics for more details about standardized residuals, leverage points, and Cook's distance.

Multicollinearity

Why multicollinearity is a problem

We can't include two variables that have a perfect linear association with each other

If we did so, we could not find unique estimates for the model coefficients

Example

Suppose the true population regression equation is y=3+4x

Example

Suppose the true population regression equation is y=3+4x

- Suppose we try estimating that equation using a model with variables x and z=x/10

Example

Suppose the true population regression equation is y=3+4x

- Suppose we try estimating that equation using a model with variables x and z=x/10

ˆy=ˆβ0+ˆβ1x+ˆβ2z=ˆβ0+ˆβ1x+ˆβ2x10=ˆβ0+(ˆβ1+ˆβ210)x

Example

ˆy=ˆβ0+(ˆβ1+ˆβ210)x

Example

ˆy=ˆβ0+(ˆβ1+ˆβ210)x

- We can set ˆβ1 and ˆβ2 to any two numbers such that ˆβ1+ˆβ210=4

Example

ˆy=ˆβ0+(ˆβ1+ˆβ210)x

We can set ˆβ1 and ˆβ2 to any two numbers such that ˆβ1+ˆβ210=4

Therefore, we are unable to choose the "best" combination of ˆβ1 and ˆβ2

Why multicollinearity is a problem

When we have almost perfect collinearities (i.e. highly correlated predictor variables), the standard errors for our regression coefficients inflate

In other words, we lose precision in our estimates of the regression coefficients

This impedes our ability to use the model for inference or prediction

Detecting Multicollinearity

Multicollinearity may occur when...

- There are very high correlations (r>0.9) among two or more predictor variables, especially when the sample size is small

Detecting Multicollinearity

Multicollinearity may occur when...

There are very high correlations (r>0.9) among two or more predictor variables, especially when the sample size is small

One (or more) predictor variables is an almost perfect linear combination of the others

Detecting Multicollinearity

Multicollinearity may occur when...

There are very high correlations (r>0.9) among two or more predictor variables, especially when the sample size is small

One (or more) predictor variables is an almost perfect linear combination of the others

Include a quadratic in the model mean-centering the variable first

Detecting Multicollinearity

Multicollinearity may occur when...

There are very high correlations (r>0.9) among two or more predictor variables, especially when the sample size is small

One (or more) predictor variables is an almost perfect linear combination of the others

Include a quadratic in the model mean-centering the variable first

Including interactions between two or more continuous variables

Detecting multicollinearity in the EDA

✅ Look at a correlation matrix of the predictor variables, including all indicator variables

- Look out for values close to 1 or -1

✅ Look at a scatterplot matrix of the predictor variables

- Look out for plots that show a relatively linear relationship

Detecting Multicollinearity (VIF)

Variance Inflation Factor (VIF): Measure of multicollinearity in the regression model

VIF(ˆβj)=11−R2Xj|X−j

where R2Xj|X−j is the proportion of variation X that is explained by the linear combination of the other explanatory variables in the model.

Detecting Multicollinearity (VIF)

Typically VIF>10 indicates concerning multicollinearity

- Variables with similar values of VIF are typically the ones correlated with each other

Use the vif() function in the rms R package to calculate VIF

VIF For SAT Model

vif(sat_model) %>% tidy() %>% kable()| names | x |

|---|---|

| Takers | 16.478636 |

| Income | 3.128848 |

| Years | 1.379408 |

| Public | 2.288398 |

| Expend | 1.907995 |

| Rank | 13.347395 |

VIF For SAT Model

vif(sat_model) %>% tidy() %>% kable()| names | x |

|---|---|

| Takers | 16.478636 |

| Income | 3.128848 |

| Years | 1.379408 |

| Public | 2.288398 |

| Expend | 1.907995 |

| Rank | 13.347395 |

Takers and Rank are correlated. We need to remove one of these variables and refit the model.

Model without Takers

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | -213.754 | 122.238 | -1.749 | 0.087 |

| Income | 0.043 | 0.133 | 0.322 | 0.749 |

| Years | 22.354 | 6.266 | 3.567 | 0.001 |

| Public | -0.559 | 0.559 | -0.999 | 0.323 |

| Expend | 2.094 | 0.824 | 2.542 | 0.015 |

| Rank | 9.803 | 0.872 | 11.245 | 0.000 |

## # A tibble: 1 x 3## adj.r.squared AIC BIC## <dbl> <dbl> <dbl>## 1 0.863 476. 489.Model without Rank

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 535.091 | 164.868 | 3.246 | 0.002 |

| Income | -0.117 | 0.174 | -0.675 | 0.503 |

| Years | 26.927 | 7.216 | 3.731 | 0.001 |

| Public | 0.536 | 0.607 | 0.883 | 0.382 |

| Expend | 2.024 | 0.980 | 2.066 | 0.045 |

| Takers | -3.017 | 0.335 | -9.014 | 0.000 |

## # A tibble: 1 x 3## adj.r.squared AIC BIC## <dbl> <dbl> <dbl>## 1 0.814 491. 505.Recap

Identifying influential points

- Leverage

- Standardized residuals

- Cook's Distance

Multicollinearity